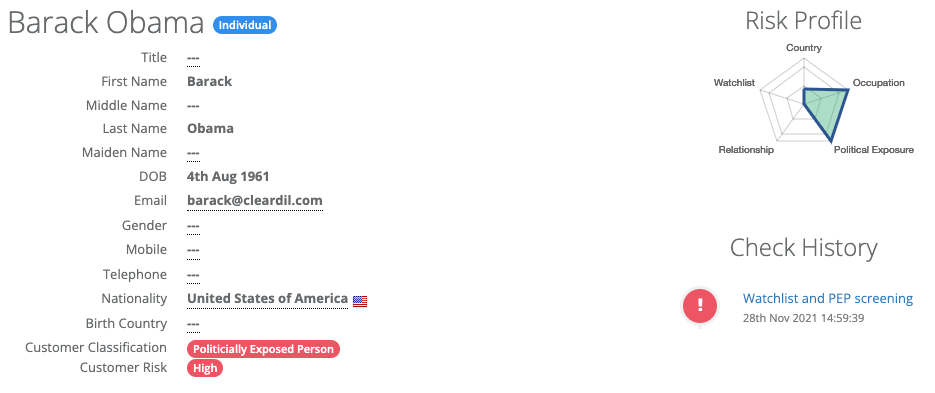

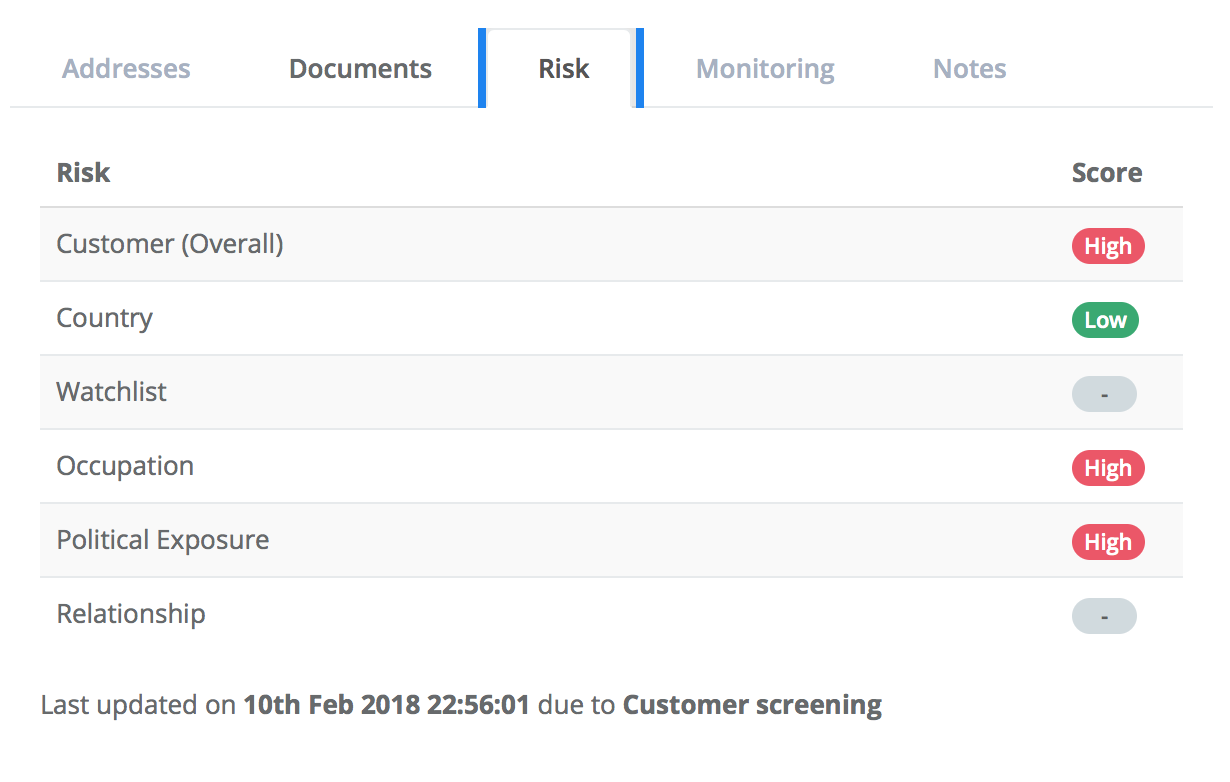

Review Risk Profile

The Risk Profile is designed to provide you with a high-level snapshot of the key customer attributes and risk indicators that will assist you in managing AML risk and applying the required due diligence: Customer Due Diligence (CDD) or Enhanced Due Diligence (EDD).

Once a screening is complete or customer details are updated, ClearDil automatically updates the corresponding customer Risk Profile.

Click on the ‘Details’ link , which is next to the ‘Customer Name’, to return the ‘Customer Profile’ page.

You will now notice ‘Customer Classification’ and ‘Customer Risk’ have both been updated due to the validation decisions taken. ‘Customer Classification’ indicates the class of customer, and is set based on the type of match you confirmed / dismissed. These include:

- Standard Customer: a customer that has cleared all the screening requests undertaken thus far.

- Watchlist Person or Company: a customer with a confirmed match against our Global Watchlist database.

- Politically Exposed Person: a customer with a confirmed match against our PEP database.

- Adverse Media Person or Company: a customer with a confirmed match against our Adverse Media database.

- Disqualified Person or Company: a customer with a confirmed match against our Disqualified Entities database.

The more information you provide about a customer, the richer and the more accurate the Risk Profile will be.